Rauner: Cut taxes, 'wasteful spending' to curb deficit

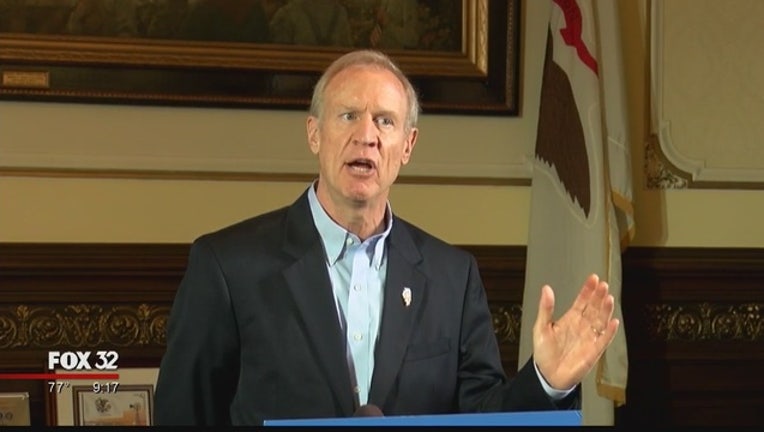

SPRINGFIELD, Ill. (AP) — Gov. Bruce Rauner said Monday that he will propose rolling back last year’s income tax increase in a “step-down” process over several years while also tackling a continuing deficit of billions of dollars.

The Republican, who will propose a budget outline next month, revealed his plan to pare down the tax increase — a $5 billion-a-year revenue boost — in response to a report that the state spent $2 billion that lawmakers never approved.

Comptroller Susana Mendoza’s first-of-its-kind monthly review Monday detailed Illinois’ $9 billion in overdue bills. Mendoza, a Democrat, pointed out that in addition to that pile, the state has $2.3 billion that it’s obligated to pay, but which the General Assembly never appropriated.

Rauner, who’s facing a tough re-election campaign this year, was asked about the deficit after a visit to a Skokie high school.

“It’s going to take a few years, but we’re going to step down the income tax increase and put more money in education, shrink the wasteful spending in government and close this deficit,” he said. “We’ve had a deficit now for years and even after a tax hike, there are deficits.”

Mendoza’s review results from a law adopted in November. It also pointed out that the backlogged spending, which hit $16.7 billion in November before borrowing paid off a portion of it, carries with it a $1 billion late-payment surcharge run up since mid-2015, the beginning of a two-year budget deadlock between Rauner and Democrats who control the Legislature.

It ended last summer when several House Republicans helped Democrats override Rauner’s veto of an increase in the income tax from 3.75 percent to 4.95 percent.

Democrats have claimed that much of the unappropriated spending came from Rauner, who continued during the impasse to sign contracts with providers of good and services without a guarantee that the money would be approved to pay the bills.

Of the backlog — which stood at $8.8 billion Monday — Mendoza’s report said $2.5 billion had not yet been sent to the comptroller for processing by the agencies that incurred them. Before now, agencies weren’t required to report the amounts they were still holding. But knowing what is coming from the agencies is part of why Mendoza wanted the law.

“This report will be an effective cash-management tool for my office and provides a much greater level of transparency for taxpayers and policymakers,” Mendoza said in a statement.

Eighty of 84 agencies complied on time, Mendoza’s office said. The biggest of the four who failed is the Department of Children and Family Services. A spokesman for DCFS did not respond to a question as to why.