100,000 borrowers now qualify for student loan forgiveness under PSLF waiver: Education Department

The Biden administration has identified 100,000 borrowers that now qualify for $6.2 billion worth of debt relief under a popular student loan forgiveness program. (iStock)

The Department of Education confirmed Wednesday that 100,000 borrowers are now eligible for $6.2 billion worth of student loan forgiveness through a program benefiting public service workers.

Under the Public Service Loan Forgiveness program (PSLF), public servants are able to have their student debt balances discharged after making 120 qualifying payments on their loans. This would effectively allow PSLF applicants to achieve student loan forgiveness after 10 years of repayment.

- U.S. Secretary of Education Miguel Cardona

The Biden administration overhauled the program last October through a limited PSLF waiver that made it easier to qualify for a loan discharge by giving borrowers credit for past periods of repayment. Prior to the changes, about 98% of PSLF applications were rejected.

"Our nation's public service workers must be able to rely on the promise of Public Service Loan Forgiveness," said Education Secretary Miguel Cardona. "The Biden-Harris administration is delivering on that promise by helping more and more eligible borrowers get their loan balances forgiven."

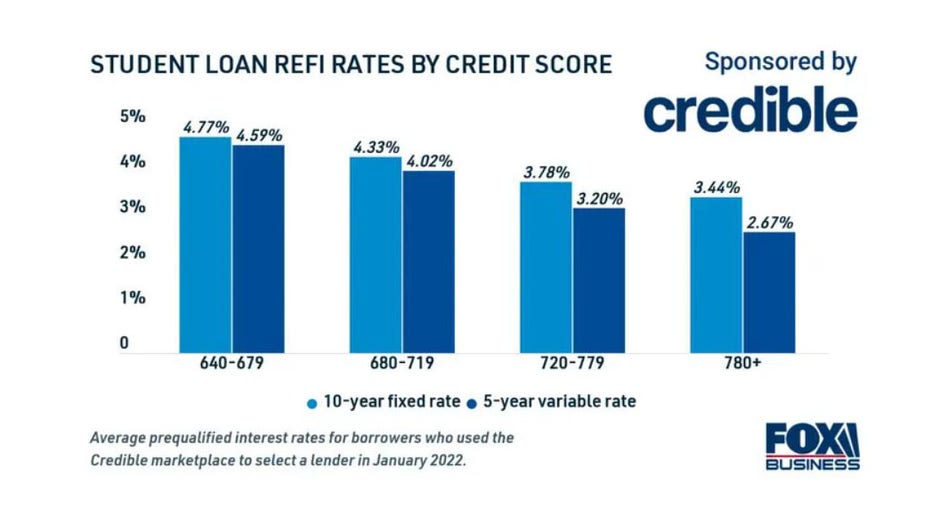

Keep reading to learn more about PSLF to see if you qualify for this program. If you're not eligible for student debt cancellation, consider your alternative options like income-driven repayment and student loan refinancing. You can compare student loan refinance rates on Credible for free without impacting your credit score.

THIS IS THE AVERAGE STUDENT LOAN DEBT IN EVERY STATE

Who is eligible for the PSLF program?

Public Service Loan Forgiveness makes it possible for select borrowers to qualify for a federal student debt discharge after making payments on their loans for a period of 10 years. The program is available to public service workers like nurses, teachers, military personnel, first responders and nonprofit employees. To be eligible for PSLF, borrowers must:

- Be employed full-time by a federal, state, local or tribal government or nonprofit organization

- Have Direct Loans or consolidate other federal loans into the Direct Loan program

- Repay your debt under an income-driven repayment plan (IDR)

- Make 120 payments while you're fully employed by a qualifying employer

Last year, the Education Department changed the PSLF program rules "for a limited time as a result of the COVID-19 national emergency."

Under the limited waiver, any prior payment made by a PSLF applicant would count as a qualifying payment regardless of the loan type, repayment plan or whether the payment was made on time and in full. In order to qualify, borrowers will need to move their federal student debt, like Federal Family Education Loan (FFEL) Program loans or Federal Perkins Loans, into a Direct Consolidation Loan by Oct. 31, 2022.

As a result of these changes, the department estimates that more than 550,000 borrowers are two years closer, on average, to achieving a student loan discharge. And on March 9, the department announced that it has now identified 100,000 borrowers who are eligible for forgiveness under PSLF.

You can see if you qualify for this program using the PSLF Help Tool. If you don't meet the PSLF eligibility requirements, you may be considering other ways to manage your student loan debt. One strategy is to refinance to a private student loan at a lower interest rate.

Although student loan refinancing may help you repay your debt on more favorable terms, it would make you ineligible for certain government protections like IDR plans, deferment, COVID-19 administrative forbearance and federal student loan forgiveness programs like PSLF. You can learn more about student loan refinancing on Credible to determine if this debt repayment method is right for your financial situation.

BIDEN ADMINISTRATION BEGINS NOTIFYING BORROWERS OF STUDENT LOAN SERVICER CHANGES

How to manage your student debt if you don't qualify for PSLF

Although the Biden administration has made it easier for some borrowers to qualify for the PSLF program, millions of Americans still owe student loan debt. If you don't qualify for PSLF, consider these alternative student loan repayment strategies:

- Enroll in income-driven repayment

- Research your other student debt forgiveness options

- Refinance your student loan debt

Learn more about each method in the sections below.

Enroll in income-driven repayment

Federal student loan borrowers may be able to limit their monthly payments to 10-20% of their disposable income by enrolling in an IDR plan. Federal Student Aid (FSA) offers four types of IDR plans: Revised Pay As You Earn Repayment Plan (REPAYE Plan), Pay As You Earn Repayment Plan (PAYE Plan), Income-Based Repayment Plan (IBR Plan) and Income-Contingent Repayment Plan (ICR Plan).

The plan you qualify for depends on the type of student loans you have. Under these plans, you may be eligible to discharge the remaining balance of your federal student debt after making payments for a period of 20 or 25 years. You can sign up for an IDR plan by logging in to your account on the FSA website.

TWO STUDENT LOAN SERVICERS END FEDERAL CONTRACTS, DESERTING 10M BORROWERS

Research your other student debt forgiveness options

PSLF is just one of several student loan forgiveness programs offered by the federal government. The Education Department has forgiven $16 billion worth of student loan debt for about 680,000 borrowers since President Joe Biden took office under PSLF and the following programs:

- Total and permanent disability (TPD) discharge program. Borrowers who are totally and permanently disabled may qualify to have their federal student loans discharged. More than 400,000 borrowers have qualified for $7.8 billion worth of student loan forgiveness through TPD discharges.

- Borrower defense to repayment program. If you were misled by a school that engaged in misconduct while you were enrolled, you may qualify for a borrower defense discharge. The Biden administration has approved $2 billion worth of debt relief for more than 107,000 borrowers under this program.

- Closed school discharge program. You may be eligible for student loan relief if your school closes while you're enrolled or shortly after you withdraw. About 115,000 students who attended the now-defunct ITT Technical Institute have received $1.26 billion worth of forgiveness under Biden.

Additionally, Biden campaigned on forgiving $10,000 worth of student loan debt per borrower as a presidential candidate. Although the president has not yet enacted widespread student debt cancellation, White House Chief of Staff Ron Klain recently said that Biden is still considering student loan relief.

47K VETERANS AND ACTIVE-DUTY TROOPS WILL AUTOMATICALLY RECEIVE STUDENT LOAN RELIEF

Refinance your student loan debt

Student loan refinancing is when you take out a private student loan to repay your current student debt. Refinancing to a lower interest rate may help you reduce your monthly payments, pay off debt faster and save money over the life of the loan.

Private lenders determine student loan refinancing rates based on the loan amount and length of the loan, as well as the applicant's creditworthiness. Well-qualified borrowers with good credit will see lower rates, while those with bad or fair credit may not qualify. If you don't meet the eligibility requirements, you could consider refinancing your student loans with a creditworthy cosigner.

It's important to remember that refinancing your federal student debt into a private loan would make you ineligible for the current zero-interest forbearance period and all federal student loan forgiveness measures. But if you already have private student loan debt, then it may be worthwhile to refinance for more favorable terms.

You can compare current student loan rates from multiple private lenders in the table below. Then, you can use Credible's student loan refinancing calculator to estimate your new monthly payment and potential savings.

BIDEN SHOULD 'UNILATERALLY' CANCEL STUDENT LOAN DEBT, SAYS OBAMA'S EDUCATION SECRETARY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.