Paperwork error puts Chicago-area veteran’s home at risk

Chicago area veteran in danger of losing his home over tax mistake

A suburban veteran could lose his home after a paperwork mistake and a fight between the county and his bank.

CHICAGO - It’s the dream so many veterans share — to serve their country, come home and finally have a place to call their own.

But a paperwork mistake and a tug-of-war between Cook County and his bank now threaten to take away the home one veteran fought so hard to earn.

What we know:

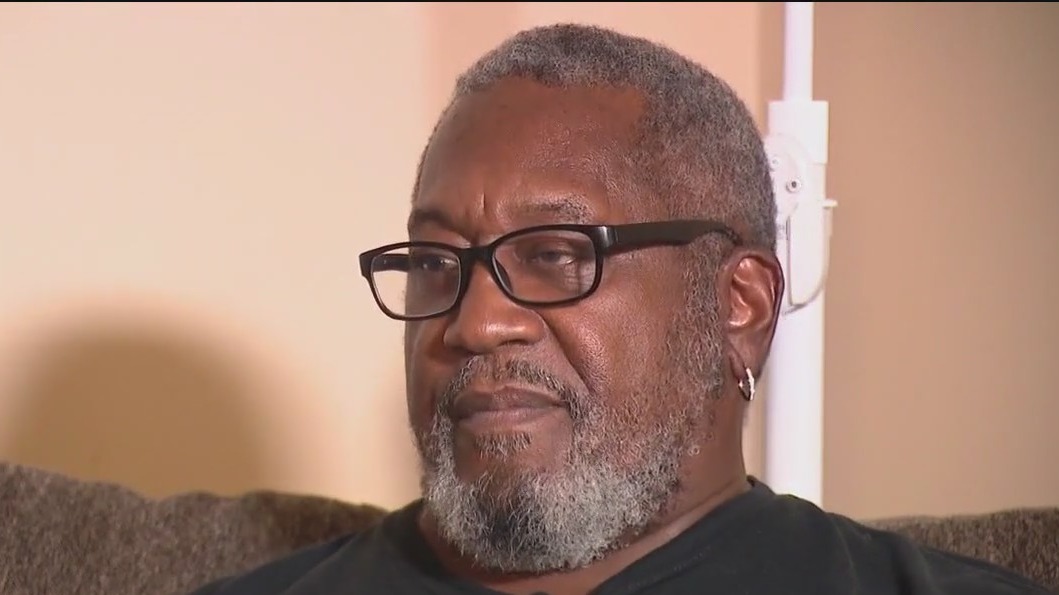

We first met Martin Guest a year ago, when he was facing a $10,000 property tax bill he should never have owed.

Since then, things have only gotten worse.

UPDATE:

Featured

Illinois Army veteran spared foreclosure after tax mix-up resolved in Chicago suburb

A Cook County veteran nearly lost his home over a tax error, but 24 hours later, everything changed.

The backstory:

Guest’s dream of homeownership — a place to raise his son after more than two decades of military service — has been overshadowed by letters, bills and the constant fear of losing everything.

After receiving a foreclosure notice, Guest worries he and his teenage son could be forced onto the streets, with only his emotional support dog by their side.

Guest served 21 years in the U.S. Army. As a single father, he wanted nothing more than to give his son a stable home and live out the American dream.

In the summer of 2023, he bought a modest home in suburban Glenwood from another disabled veteran.

But just months after moving in, that $10,000 tax bill arrived.

The county later corrected the mistake, issuing a certificate of error that reduced his tax bill to zero. Yet the problem keeps resurfacing.

In August, the Cook County Assessor’s Office sent a letter confirming Guest’s property tax exemption. He shared that documentation with his lender, U.S. Bank, but the bank still lists him as responsible for property taxes — nearly doubling his mortgage payment to account for taxes he doesn’t owe.

The mortgage company paid Cook County the disputed taxes, and the county issued only a partial refund to the lender.

Under state law, Guest owes nothing. He is exempt from property taxes because of his disability.

Yet last month, Guest received a foreclosure notice — putting his family’s home, and his hard-earned peace of mind, at risk once again.

What's next:

The Cook County Assessor’s Office responded to our story, acknowledging the errors and missing paperwork, and promised to correct the issue.

Their statement is shared below:

"He is currently enrolled in the veterans with disabilities exemption, which automatically renews each year. So his tax bill going forward is $0.

"After he bought the home in August 2023, he received a Certificate of Error to refund his taxes for the rest of the year. However, the previous owner had not applied for the veterans with disabilities exemption from Jan. 2023 to July 2023. That meant Mr. Guest received a tax bill for about $6,800 for that period of time.

"This May, the previous owner submitted a Certificate of Error application for Jan. 2023 to July 2023. We cannot process this at the moment because we are waiting for other offices in the property tax system to complete the upgrade to a new system of record. (See here for more details about that project: https://www.cookcountyil.gov/propertytaxtracker)

"Once we can process Certificates of Error, we will get Mr. Guest the remaining refund for 2023."

The clock is ticking, but it’s unclear how long that will take.

Guest’s home is already in foreclosure, and there’s real concern the process could move faster than the corrections — putting everything he’s fought for at risk.

FOX 32 Chicago has also reached out to U.S. Bank but has not yet received a response.

The Source: The information in this article was reported by FOX 32's Tia Ewing.