Dockworker strike wasn’t expected to affect gas prices — but that’s not the case now

The union dockworkers strike that began early Tuesday impacting dozens of U.S. ports is not expected to disrupt the oil and gas industry right away, but experts say that will eventually change if the work stoppage lasts long enough.

The Department of Energy (DOE) issued a statement after the strike began saying the shutdown of the 36 East and Gulf Coast ports "will not impact crude oil, gasoline, natural gas, and other liquid fuel exports and imports, as such operations are handled by other workers. Therefore, the strike will not have any immediate impact on fuel supplies or prices."

Dockworkers strike at the Bayport Container Terminal in Seabrook, Texas, on Tuesday. (Mark Felix/AFP via Getty Images / Getty Images)

In response to the DOE's statement, oil and gas expert Adam Ferrari, CEO of Phoenix Capital Group, told FOX Business, "While you can say there might not be an ‘immediate’ impact, there is still the consideration of the overall economic hit the U.S. will take across all industries, including the oil and gas industry."

Ferrari noted that the East and Gulf Coast ports are responsible for approximately half of U.S. container imports. So if the strike heightens, he says, it is possible that the entire supply chain is affected.

The supply chain is essential for the oil and gas industry to import and export their products, and Ferrari argues that because of these strikes, there could be major disruptions in shipments and product shortages. He said the labor of loading and unloading natural gas products could also be disturbed, potentially leading to shortages and price hikes — especially on the consumer end.

"This is a domino effect," Ferrari said. "Increased gas prices could also lead to fluctuations in stock prices and investor and market uncertainty. In turn, it could also impact government regulation and policies, of which already have existing tensions within this sector."

Phil Flynn, an energy market analyst and FOX Business contributor, wrote in his daily Phil Flynn Energy Report on Tuesday that "the biggest hit to oil from the dockworkers strike will be on demand."

"Oil tankers and LNG will not be impacted as the Longshoremen strike is impacting container ships, but when those ships don’t move they will not burn oil," Flynn wrote. "The possibility that factories may shut down because of the strike will also reduce demand for oil and could lead to a larger U.S. recession, further hampering demand."

US PORT WORKER SPEAKS OUT ON THE PICKET LINE: ‘WE’VE TAKEN LESS THAN WE'VE DESERVED IN THE PAST'

The International Longshoremen's Association (ILA), which represents 45,000 dockworkers, began its first strike since 1977 after its six-year contract with the U.S. Maritime Alliance (USMX), which represents port employers, expired Monday night.

Negotiations between the ILA and USMX have been deadlocked thus far over the union's demands related to wage hikes and compensation, as well as protection from automation at ports.

Dockworkers strike at the Bayport Container Terminal in Seabrook, Texas, on Tuesday. (Mark Felix/AFP via Getty Images / Getty Images)

Meanwhile, several industries will see immediate disruptions from the strike, and trade groups are calling President Biden to intervene.

BUSINESS GROUPS CALL ON BIDEN TO INTERVENE IN PORT STRIKE

The Associated Builders and Contractors (ABC), the National Association of Wholesaler-Distributors (NAW), the National Retail Federation (NRF), the National Association of Manufacturers (NAM), the U.S. Chamber of Commerce and other groups have issued statements urging Biden to use his authority under the Taft-Hartley Act to force ports to resume operations while labor negotiations continue.

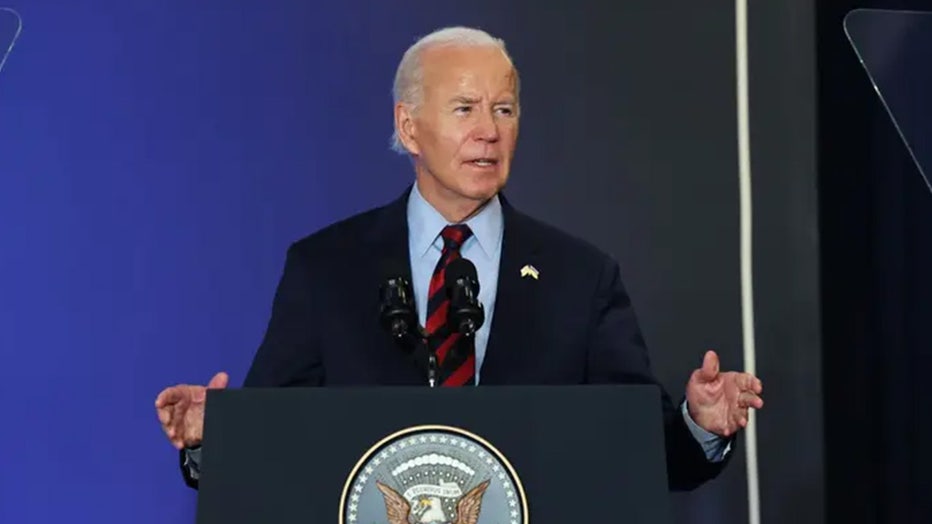

The president said over the weekend that he would not intervene in the port strike, saying he doesn't "believe in Taft-Hartley."

President Biden said over the weekend he would not use his authority under Taft-Hartley to intervene to stop the dockworkers' strike. (Michael M. Santiago/Getty Images / Getty Images)

U.S. seaports from Maine to Texas will be impacted by the strike. Those ports collectively handle about half of U.S. imports and are also critical hubs for exports from American businesses.

An analysis by JPMorgan estimated the daily cost of a port strike by East and Gulf Coast port workers would cost the U.S. economy between $3.8 billion and $4.5 billion per day as operations slow.

However, Anderson Economic Group (AEG), which specializes in economic impact estimates, expects the total cost of the strike to be much lower, at $2.1 billion for the first week.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Still, Patrick Anderson, principal and CEO of AEG, told FOX Business he agrees with JPMorgan's analysts that the duration of the strike is likely to be determined by whether the Biden administration intervenes.

FOX Business' Eric Revell contributed to this report.