Tax relief bill could get you a larger refund

The government could owe you a little more in your tax refund this year if a bill on Capitol Hill goes through. It’s called the Tax Relief for American Families and Workers Act, and it would lower tax bills for businesses and families. People with children currently get up to $1,600 in child tax credits. This bill would increase that to $1,800 for last year, $1,900 this year, and $2,000 for next year.

IRS begins accepting tax returns starting today

Today marks the first day the IRS begins accepting and processing 2023 tax returns.

Tax season kicks off with some changes

It's officially tax season. The IRS has rolled out a few tweaks this year to account for higher-than-normal inflation last year.

Americans living paycheck to paycheck

More than half of Americans said they would not be able to afford a $1,000 emergency expense, according to a recent survey. Economic analyst Mark Hamrick has some tips on how to build up an emergency savings account.

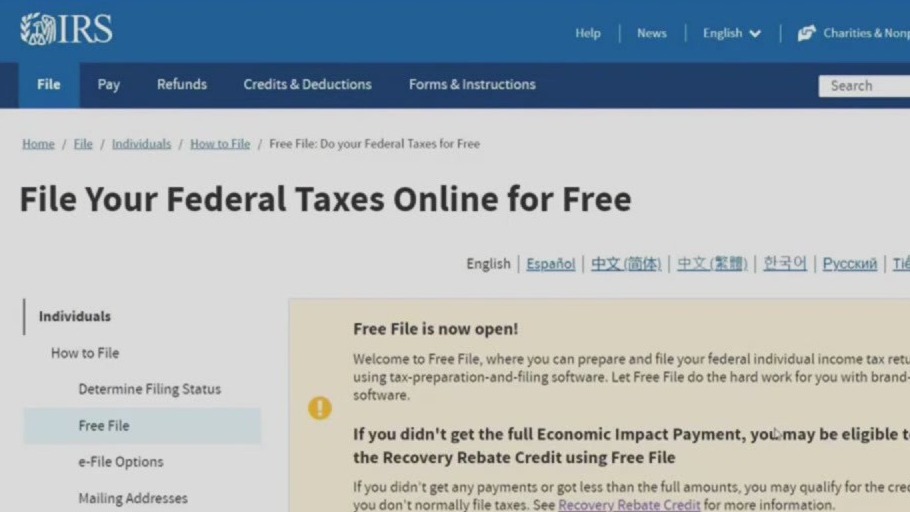

IRS launches its free-filing pilot program in 12 US states

With tax season kicking off Monday, the IRS is rolling out a new online option for filing your 2023 returns. Here's how it works.

Layoff list: Major tech companies that have cut jobs so far in 2024

More than 20,000 jobs have already been shed in the tech industry just three weeks into the new year, according to one layoff tracking site.

Most Americans cannot afford a $1K emergency expense

Thirty-five percent of adults surveyed said they'd have to borrow money if they had a $1,000 unexpected expense.

Study: Gen Z, millennials are ‘obsessed’ with idea of being rich

The study found that nearly 60% of millennials said they feel behind financially, likely contributing to feelings of financial inadequacy.

Gray collar jobs: Tips for making money without a college degree

Dan Roccato, professor at the University of San Diego, talks about the importance of gray collar jobs and how you can make money even without a college degree.

Tips on avoiding rewards scams

You probably spent a lot of money on holiday gifts and may have racked up some rewards points. Now, scammers are trying to take advantage of that.

Janet Yellen gives remarks on economic indicators in Chicago

U.S. Treasury Secretary Janet Yellen was in the Windy City for an event hosted by the Economic Club of Chicago on Thursday.

Biden cancels another $5 billion in student loan forgiveness – Here's who is impacted

The Biden Administration announced an additional $5 billion in student loan forgiveness that impacts borrowers using the income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF) plans.

Illinois tax season 2024: Here's when the state, IRS will send out refunds

Here's everything Illinois residents need to know about this year's tax season.

When will the IRS send out tax refunds

The IRS says most taxpayers should expect their refund within 21 days of filing but it could take longer for some.

How to make loud budgeting work

Here are some tips on how to properly budget this year.

Here are the US states where you’ll pay less individual income tax in 2024

Several U.S. states are lowering individual income tax rates this year, meaning more financial relief for American taxpayers.

Ways to save on rising car insurance rates: Tips to cut costs amid premium increases

In a FOX 32 Special Money Saver Report, we take a look at how you can save some money with car insurance rates on the rise.

Ways to save on rising car insurance rates: Tips to cut costs amid premium increases

While your car is a big-ticket purchase, paying to insure it doesn't have to be.

Indiana tax cuts: Significant changes took effect in 2024 — what to know

Residents of Indiana should know about changes to the state's tax policy that took effect on Jan. 1, 2024.

Social Security is coming for a bigger chunk of your paycheck

The portion of personal income subject to the Social Security tax has increased to $168,600 this year from $160,200 in 2023.